pant-era-tigris.ru Overview

Overview

What Is Delinquent On Credit Report

While negative repayment history will appear on your Credit Report, including any late payments, arrears, or defaults, the term 'Delinquent' is unlikely to. Graph and download economic data for Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) from Q1 to Q2 about credit cards. Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit. The Delinquent Account Collections Program reports all unpaid accounts to Experian. In most cases, accounts are reported to this consumer credit reporting. The number of past due items on a credit report; Bankruptcy public records; The amount of time that's passed since delinquencies, bankruptcy public records or. I've observed that a credit score is largely determined by how much available credit you have vs. how much you're using. For example if you have. The Delinquent Accounts Program reports unpaid accounts to various credit reporting agencies. In most cases, accounts are reported to these credit reporting. See Demand Letter Checklist at. Appendix 8. Prior to entering into an installment agreement, an agency should obtain a financial statement or credit report to. A loan becomes delinquent when you make payments late (even by one day) or miss a regular installment payment or payments. A loan goes into default—which is the. While negative repayment history will appear on your Credit Report, including any late payments, arrears, or defaults, the term 'Delinquent' is unlikely to. Graph and download economic data for Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) from Q1 to Q2 about credit cards. Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit. The Delinquent Account Collections Program reports all unpaid accounts to Experian. In most cases, accounts are reported to this consumer credit reporting. The number of past due items on a credit report; Bankruptcy public records; The amount of time that's passed since delinquencies, bankruptcy public records or. I've observed that a credit score is largely determined by how much available credit you have vs. how much you're using. For example if you have. The Delinquent Accounts Program reports unpaid accounts to various credit reporting agencies. In most cases, accounts are reported to these credit reporting. See Demand Letter Checklist at. Appendix 8. Prior to entering into an installment agreement, an agency should obtain a financial statement or credit report to. A loan becomes delinquent when you make payments late (even by one day) or miss a regular installment payment or payments. A loan goes into default—which is the.

What are the different categories of late payments and how does your FICO® Score consider late payments? · days late · days late · days late · days. Default occurs on a federal student loan after days of delinquency and may include severe consequences such as immediate payment of the balance in full. Credit delinquency simply refers to the act of falling behind on required monthly payments to your credit card company. Creditors are not allowed to report a. What's a credit score? · how much money you owe · whether you've paid on time or late · how long you've had credit · how much new credit you have · whether you asked. A credit card delinquency is when you make a payment after the due date on your credit card statement. You might think that one missed payment doesn't matter. Graph and download economic data for Delinquency Rate on Credit Card Loans, All Commercial Banks (DRCCLACBS) from Q1 to Q2 about credit cards. Mortgage Delinquencies; Past-Due, Collection, and Charge-Off of Non-Mortgage Accounts; Prior Bankruptcy, Foreclosure, Deed-in-Lieu of Foreclosure. 31 CFR § - Reporting delinquent debts to credit bureaus. § Reporting delinquent debts to credit bureaus. (4) The debtor may avoid having the. MYTH: If my bill is delinquent, the GTCC contractor will automatically report my delinquency to the credit bureaus, affecting my credit score. FACT: An. This dictates when credit card companies will report you as being late to the credit bureaus as well as how much credit score damage you incur. 1 - 29 days. At. The effects of late payments are long-lasting but not permanent. A late payment will be removed from your credit reports after seven years. However, late. This dictates when credit card companies will report you as being late to the credit bureaus as well as how much credit score damage you incur. 1 - 29 days. At. Generally, accounts sent to collections will be listed on your credit report for up to 7 years, beginning days from the most recent delinquent period before. For example, a delinquent nontax debt that has been written off the books of the creditor agency or reported to the Internal Revenue Service as discharged (i.e. If you have a charge-off on your credit report, it's likely been sold to a third-party collection agency. If your debt is still unpaid, consider debt. If you have a charge-off on your credit report, it's likely been sold to a third-party collection agency. If your debt is still unpaid, consider debt. It can appear on your report as a derogatory remark and has the potential to lower your credit score by points or more. Late payments stay on your report. The number of past due items on a credit report; Bankruptcy public records; The amount of time that's passed since delinquencies, bankruptcy public records or. Nothing. Just wait. Time heals all wounds. Just because you have paid a delinquency does not mean the derogatory data has been removed or. 31 CFR § - Reporting delinquent debts to credit bureaus. § Reporting delinquent debts to credit bureaus. (4) The debtor may avoid having the.

How To Get Out Of Debt Collection

Never give them any money. Tell them to stop calling. Investigate your credit report to make sure that the item they want to collect is not on. Collection agencies. OSAP and student loan repayment. Creditor options for collecting debts. Debt repayment methods. Ways to Get Out of Debt. Try a balance transfer card to get out of debt. If your debt has not gone to collections yet, one option to help you save tons on interest and pay it off. Maintenance or arrears will be paid before any other debts in situations where several creditors try to collect from a debtor who is in financial trouble. Initial Contact from Debt Collectors · They must identify themselves as a debt collection agency and give their name and the address for the collection agency. Avoid companies—including out-of-state lawyers—that offer to eliminate or cut your debts by negotiating with your creditors. These operations typically collect. You can also ask the debt collector for additional information. Because all scams are different, you might have to reach out to a few other local, state, and. When debt collectors first contact you, they should tell you the amount that you owe, the name of the creditor, and that you have 30 days to dispute the debt in. You can attempt to settle debts on your own or hire a debt settlement company to assist you. Typical debt settlement offers range from 10% to 50% of the amount. Never give them any money. Tell them to stop calling. Investigate your credit report to make sure that the item they want to collect is not on. Collection agencies. OSAP and student loan repayment. Creditor options for collecting debts. Debt repayment methods. Ways to Get Out of Debt. Try a balance transfer card to get out of debt. If your debt has not gone to collections yet, one option to help you save tons on interest and pay it off. Maintenance or arrears will be paid before any other debts in situations where several creditors try to collect from a debtor who is in financial trouble. Initial Contact from Debt Collectors · They must identify themselves as a debt collection agency and give their name and the address for the collection agency. Avoid companies—including out-of-state lawyers—that offer to eliminate or cut your debts by negotiating with your creditors. These operations typically collect. You can also ask the debt collector for additional information. Because all scams are different, you might have to reach out to a few other local, state, and. When debt collectors first contact you, they should tell you the amount that you owe, the name of the creditor, and that you have 30 days to dispute the debt in. You can attempt to settle debts on your own or hire a debt settlement company to assist you. Typical debt settlement offers range from 10% to 50% of the amount.

The debtor may want to dispute the debt because they don't believe the debt is theirs, or they think the amount is incorrect. The Consumer Financial Protection. Never give them any money. Tell them to stop calling. Investigate your credit report to make sure that the item they want to collect is not on. See if your bank or credit union can help you consolidate all of your consumer debts into one loan with one payment at a lower interest rate. This can be a. If you have some cash on hand, you might consider negotiating with the collector. You could offer a lump-sum settlement or try to work out a payment plan. If. So, if you want to bypass a debt collector, contact your original creditor's customer service department and request a payment plan. This is a time when people become vulnerable to unscrupulous agencies collecting debts or claiming to help individuals out of debt. Fortunately, there are. Can a debt be too old to collect? An outstanding debt can be written off by a creditor to balance their books, and while this could lower the debt's priority. How to Bypass Debt Collectors and Work with Your Original Creditor. Dealing with a debt collector can be intimidating and costly. Here's when you may be able to. Debt settlement companies often have you make regular payments to them toward an escrow-like account to be used for the payment to the creditor. Another. Start by sending a written letter to the debt collection agency contesting the debt—and make sure you do it within 30 days of being contacted by a debt. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. If you have a single account that is charged-off or has already been sold to a third-party collector, you work out a settlement directly with that company. In. The debt doesn't go away just because you've asked to be contacted in writing only. You may continue to owe the debt even if you have disputed the amount. When. What to do · Get transcript to verify the assignment of your account to a private collection agency · How to know the private collection agency calling is. If you have a court date related to debt collection · Don't miss your court date! · If you can't afford to pay a debt let the court know. · If you agree to a. Pay off the debt. Some collectors will accept less than what you owe to settle a debt. Before you make any payment to settle a debt, get a signed letter. Make a budget, record your income and your expenses, and follow a repayment plan. Some lenders are willing to negotiate on interest rates or the amount owing. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. The law requires them to cease contact unless they are letting you know that they are going to stop attempts to collect the debt or that they are taking. the debt. An agency fulfills its affirmative responsibility to try to collect delinquent debts by engaging in “active collection.” “Active collection”.

Use Balance Transfer To Pay Off Loan

Say you have a credit card balance of $5, on a card with 15% APR. Transferring the balance to another card with a 0% APR offer and paying it off during the. Easier debt consolidation:If you want a loan to help pay down or consolidate multiple other debts, balance transfer loans can take some work off your plate. A balance transfer credit card and a personal loan are both good options if you're struggling to pay off debt. A balance transfer credit card is best for. Find a credit card with the longest period of low or no interest. · Make sure the amount you're saving on interest is greater than the transfer fee. · Strategize. Under the terms of the balance transfer offer, you will pay off your credit card balance 3 month(s) earlier and save $ in interest charges over the. You can keep transferring credit card balances if you continue to qualify for new balance transfer cards. But it might not be the best strategy for paying. Whether to use a balance transfer or a personal loan to pay off credit card depends on how much debt you have. For example, if you have a relatively small. This is the “snowball” way of paying off debt. As you knock out smaller balances, it frees up more money to be applied toward higher balances. Seeing the. To sum up: If you're currently paying off a high-interest loan, you might find it much less expensive to take out a balance transfer card with a zero interest. Say you have a credit card balance of $5, on a card with 15% APR. Transferring the balance to another card with a 0% APR offer and paying it off during the. Easier debt consolidation:If you want a loan to help pay down or consolidate multiple other debts, balance transfer loans can take some work off your plate. A balance transfer credit card and a personal loan are both good options if you're struggling to pay off debt. A balance transfer credit card is best for. Find a credit card with the longest period of low or no interest. · Make sure the amount you're saving on interest is greater than the transfer fee. · Strategize. Under the terms of the balance transfer offer, you will pay off your credit card balance 3 month(s) earlier and save $ in interest charges over the. You can keep transferring credit card balances if you continue to qualify for new balance transfer cards. But it might not be the best strategy for paying. Whether to use a balance transfer or a personal loan to pay off credit card depends on how much debt you have. For example, if you have a relatively small. This is the “snowball” way of paying off debt. As you knock out smaller balances, it frees up more money to be applied toward higher balances. Seeing the. To sum up: If you're currently paying off a high-interest loan, you might find it much less expensive to take out a balance transfer card with a zero interest.

Balance transfer credit cards and personal loans are ways to help save on interest and reduce your overall payment. Explore what is better for you at. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. From choosing the card to paying down your balance, research the best offer and then pay down your debt. Decide which credit card to use. If you already have. If you want to pay off credit card debt faster, a balance transfer is a great option 1. Consolidate multiple credit cards into one monthly payment, and pay. To pay off the original loan in 24 months, your monthly payment is $ (give or take a few cents). To pay off the loan using your balance. Wait for the transfer to go through. Once the balance transfer is approved, which could take two weeks or longer, the issuer will generally pay off your old. Instead of making minimum payments with most of the money going to interest, you can focus payments on the principal. If done correctly, a balance transfer can. Balance transfers help manage existing debt, but you might still pay interest on future purchases. That is unless you get a balance transfer credit card that. A balance transfer card can move your credit card debt onto a new card you can then pay off. Learn more about what a balance transfer is and how it works. You must use discretion. If your loan is almost paid off, transferring it to a 0% interest card could be a very savvy move. With no interest, all your spare. As the name indicates, it's simply where you take the balance from an existing credit card and transfer it to a card from another financial institution. How can. Transferring a credit card or loan balance to a new credit card with a lower APR is a helpful step toward paying down your debt, but be sure to understand. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. Someone who's struggling to pay off multiple outstanding balances on different credit cards or someone who's looking for a flexible loan option should consider. Do keep in mind that although the purpose of a balance transfer plan is to pay off existing credit card debt, most financial institutions will not allow you to. After you complete a balance transfer, it's essential to follow some guidelines so you can ensure you pay off debt within the introductory 0% APR period. Here's how to use a balance-transfer card to pay off holiday debt · 1. Identify areas you can eliminate spending. · 2. Make a monthly repayment plan and stick. Use your Wells Fargo Credit Card as a powerful financial tool · Pay off high-interest balances · Fund large expenses, such as home improvements · Cover emergencies. Simply transferring a balance to an existing card won't affect your score. But using your card responsibly—by making on-time payments and paying down the. To avoid paying interest on your debt, you open a balance transfer credit card, which comes with 20 months at 0% and a one-off fee of 3% of the amount.

Best Natural Gas Pool Heater

Inground Propane & Natural Gas Pool Heaters ; Side view of Hayward Universal H-Series H Low NOx Pool Heater, , BTU · Hayward W3HFDN Universal H-Series. One of these natural gas heaters will help keep things toasty all year long. The fast-burning fuel will quickly heat your entire pool, making these a. The top-selling product within Pool Heaters is the Raypak Digital Natural Gas Pool Heater. What are the shipping options for Pool Heaters? All Pool Heaters can. Gas Pool Heaters ; Hayward Natural Gas Pool Heater K BTU HID1 · $ ; Hayward Natural Gas Pool Heater K BTU HFDN · $ ; Hayward Natural Gas Pool. Introducing Raypak's AVIA Smart Pool Heater. The AVIA smart pool heater raises the bar on Design & Function and Industry First Wi-Fi connected swimming pool. At Royal Swimming Pools, we offer a variety of heating solutions including models that use propane, natural gas, and electricity, tailored to fit different pool. We have a great selection of spa and swimming pool heaters from top brands including Haywayd, Pentair, Jandy, Raypak, Sta-Rite and more to keep you swimming. Propane gas is more expensive than natural gas, but it is also more fuel efficient. So while it costs more upfront, it will last longer than natural gas. Pentair MasterTemp Gas Heaters The Pentair MasterTemp high performance eco-friendly gas pool heater is available in natural gas and propane burning models. Inground Propane & Natural Gas Pool Heaters ; Side view of Hayward Universal H-Series H Low NOx Pool Heater, , BTU · Hayward W3HFDN Universal H-Series. One of these natural gas heaters will help keep things toasty all year long. The fast-burning fuel will quickly heat your entire pool, making these a. The top-selling product within Pool Heaters is the Raypak Digital Natural Gas Pool Heater. What are the shipping options for Pool Heaters? All Pool Heaters can. Gas Pool Heaters ; Hayward Natural Gas Pool Heater K BTU HID1 · $ ; Hayward Natural Gas Pool Heater K BTU HFDN · $ ; Hayward Natural Gas Pool. Introducing Raypak's AVIA Smart Pool Heater. The AVIA smart pool heater raises the bar on Design & Function and Industry First Wi-Fi connected swimming pool. At Royal Swimming Pools, we offer a variety of heating solutions including models that use propane, natural gas, and electricity, tailored to fit different pool. We have a great selection of spa and swimming pool heaters from top brands including Haywayd, Pentair, Jandy, Raypak, Sta-Rite and more to keep you swimming. Propane gas is more expensive than natural gas, but it is also more fuel efficient. So while it costs more upfront, it will last longer than natural gas. Pentair MasterTemp Gas Heaters The Pentair MasterTemp high performance eco-friendly gas pool heater is available in natural gas and propane burning models.

25 products · Bypass Valve Assembly · Solar H20 Swimming Pool Heater (2 Pk) · , BTU Mastertemp Natural Gas Pool Heater · , BTU Mastertemp Propane Pool. Best Gas Pool Heater · Top Pick: Sta-Rite SRHD · Step-up Pick: Pentair MasterTemp · Budget Pick: Hayward HFDN · The Contenders: Hayward HID1. Swimming pool heaters use natural gas or propane, to create heat which is pool best! ayesha Ayesha Aslam InTheSwim Staff Blogger. In The Swim. Our final winner. best-pool-heaters. Hayward H-Series natural gas heater. The quickest. Unlike heat pump and solar pool heaters, gas pool heaters can maintain any desired temperature regardless of the weather or climate. Selecting a Gas Pool Heater. Gas-powered pool heaters will burn either propane or natural gas to heat your pool water. This allows the heater to operate in any outdoor temperature. Best Selling · Hayward Universal H-Series Heater · Hayward IDXLFLS Flame Sensor Replacement · raypak btu digital natural gas pool heater with. Natural gas or propane heaters are easy to use and keep your pool at the right temperature. They warm the water as it moves through the. Shop natural gas pool heaters for inground pools. We have the best pricing on the brands you want, lots of stock & fast shipping. Pentair UltraTemp ETi Hybrid Pool Heater · ETi High-Efficiency Commercial Pool Gas Heater · Pentair MasterTemp HD Cupro-Nickel Heater. Best Natural Gas Pool Heater: Raypak Digital Electronic Ignition The Raypak gas heater is a high-efficiency pool heater with a small footprint. This heater. Gas pool heaters use either natural gas or propane. As the pump circulates the pool's water, the water drawn from the pool passes through a filter and then to. Swimming pool gas heaters are a popular option for heating your pool as they can heat an above ground pool quickly. They utilize propane or natural gas to heat. Natural gas Pool Heaters · Raypak Digital Pilot Ignition Natural Gas Pool Heater · Raypak Pool-Heaters - View #2 · Raypak Pool-Heaters - View. COATES · Hayward · Jandy · Pentair · Raypak · Sta-Rite · JXINN Cupro Nickel K BTU Natural Gas · RAYPAK AVIA K Low NOx Nat Gas Heater WIFI Ft. Gas Heaters · Pentair Max-E-Therm Natural Gas Pool & Spa Heater K BTU SRNA · Pentair MasterTemp High Performance Eco-Friendly Pool Heater, Natural Gas. Hayward Universal H-Series Induced Draft Pool Heater K BTU Natural Gas W3HFDN (also known as HFDN) is energy-efficient. Heats up fast so no long waits before enjoying your pool or spa · Best-in-class energy efficiency* · Manual gas shut-off when service is required · Eco-friendly. If you have natural gas at your home or business, you'll want to make sure to select a Natural Gas Heater to avoid having to purchase a conversion kit. Natural. Shop for Gas Pool Heaters in Pool Heaters. Buy products such as Raypak PRAENC BTU Natural Gas Pool Heater at Walmart and save.

What Can I Buy With 10000 Dollars

I wrote in my annual planner, “I will make $10, a month by January I'll end this by saying I hope you do something amazing for. A filling for me(insurance covered it all though), was like $ total. This is in America too. I can't imagine what dentist is charging $10, Chevrolet Cruze. $5, - $8, $6, - $10, $7, - $11, $8, - $14, ; Honda Fit. $6, - $6, $6, -. Get a new Mac Pro with M2 Ultra chip from only $ per month. Select a model or customise your own. Buy now at apple Does That. Shop Mac. Shop Mac · Help. You can put a dollar amount to some of the expenses your student will be able to cover thanks to savings from the University of Dayton's fixed tuition plan. While the table above shows the exciting growth you can expect when you deposit $10, You can purchase a CD, or certificate of deposit, through most banks. Buy Cars Online. Car Research & News; Research & Information · Latest Articles See if you can save on car insurance on pant-era-tigris.ru Capital One. SPONSORED. What should you do with $10,? With $10k you can: Invest in the stock market. Buy into a Real Estate Investment Trust. Invest in bonds. How To Make $10k Fast? · 1. Become A Freelancer · 2. Invest In Cryptocurrency · 3. Participate In Online Surveys · 4. Become A Virtual Assistant · 5. Do Odd Jobs · 6. I wrote in my annual planner, “I will make $10, a month by January I'll end this by saying I hope you do something amazing for. A filling for me(insurance covered it all though), was like $ total. This is in America too. I can't imagine what dentist is charging $10, Chevrolet Cruze. $5, - $8, $6, - $10, $7, - $11, $8, - $14, ; Honda Fit. $6, - $6, $6, -. Get a new Mac Pro with M2 Ultra chip from only $ per month. Select a model or customise your own. Buy now at apple Does That. Shop Mac. Shop Mac · Help. You can put a dollar amount to some of the expenses your student will be able to cover thanks to savings from the University of Dayton's fixed tuition plan. While the table above shows the exciting growth you can expect when you deposit $10, You can purchase a CD, or certificate of deposit, through most banks. Buy Cars Online. Car Research & News; Research & Information · Latest Articles See if you can save on car insurance on pant-era-tigris.ru Capital One. SPONSORED. What should you do with $10,? With $10k you can: Invest in the stock market. Buy into a Real Estate Investment Trust. Invest in bonds. How To Make $10k Fast? · 1. Become A Freelancer · 2. Invest In Cryptocurrency · 3. Participate In Online Surveys · 4. Become A Virtual Assistant · 5. Do Odd Jobs · 6.

In any case, you've got $10, burning a hole in your pocket. What should you do with it? How about starting a business? Many entrepreneurs, possibly most. For the first time in my life, my savings account reached $10, Here's how I did it & how you can do it, too. 1. Set goals & practice visualization. At the. For example, you could buy an electronic savings bond for $ In any one calendar year, you may buy up to $10, in Series EE electronic savings bonds AND. How To Make $10k Fast? · 1. Become A Freelancer · 2. Invest In Cryptocurrency · 3. Participate In Online Surveys · 4. Become A Virtual Assistant · 5. Do Odd Jobs · 6. The value of used vehicles varies with mileage, usage and condition and should be used as an estimate. The CARFAX Vehicle History. You can put a dollar amount to some of the expenses your student will be able to cover thanks to savings from the University of Dayton's fixed tuition plan. will be eligible for up to $10, in debt relief. What does the “up to” in You might be contacted by a company saying they will help you get loan. For example, if you had $5, cash in a margin-approved brokerage account, you could buy up to $10, worth of marginable stock: You would use your cash to. Buying on emotion is just one potential car-buying pitfall. One of the most important things you can do in your 20s is to develop good financial habits. Below is a list of need-to-knows you should read before you buy. Buy Miles All transactions are processed in U.S. Dollars; All the terms and. Maximum purchase each calendar year: $10, Can cash in after 1 year. (But if you cash before 5 years, you lose 3 months of interest.) (Note: Older EE bonds. What could you do with $? I'll show you exactly how to save it in this Money Savings Challenge Printable, Save 10, Dollars in 52 Weeks - Etsy. Can We Spend $10, per Month in Retirement? May 1, Financial Planning Investment Management This will help you get a feel for ERWA's methods and. What Can You Do With $10, in Points? What's great about being a Verizon small-business customer? All the benefits Verizon offers such as the free webinars. That's because the IRS requires banks and businesses to file Form and a Currency Transaction Report, if they receive cash payments over $10, Depositing. Not because you get paid $10, an hour to do the work. But because the your deliberate investment will pay off in spades at a future date. $10, per. Lizzie Gilson to create a documentary to showcase everything the Hornbeam does; Vicky Grandon to buy a laptop for local foodbank PL84U; Duncan. can help you get approved with more favorable rates. Here's what you need to do to apply for a $10, personal loan with bad credit: Check your credit. Best Engagement rings under $10, With a budget of $10, to spend on an engagement ring, you have plenty of options. You can choose from straightforward. What should you do with $10,? With $10k you can: Invest in the stock market. Buy into a Real Estate Investment Trust. Invest in bonds.

Who Is A Creditor

A creditor could be a bank, supplier or person that has provided money, goods, or services to a company and expects to be paid at a later date. A creditor is an entity, company or individual that is owed money because they have provided a service or goods, or loaned money to you. The debtor is the party that owes the money (debt), while the creditor is the party that loaned the money. For example, if Jay loans Reva $, Reva is the. An original creditor may attempt to collect a past due credit account itself, or it may hire a debt collector. The original creditor also may sell your credit. An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy. Creditors can add fees and interest when you borrow money from them, but not all creditors do. Technically, anyone who extends you a loan can be classified as a. A creditor or lender is a party that has a claim on the services of a second party. It is a person or institution to whom money is owed. Indeed, while many secured creditors are lenders, others can have security interests arising from state law (e.g., a mechanic's lien) or a judicial lien arising. A creditor is a person or organisation that provides credit. The credit will have a financial value. It may not, however, be provided in cash. For example, if a. A creditor could be a bank, supplier or person that has provided money, goods, or services to a company and expects to be paid at a later date. A creditor is an entity, company or individual that is owed money because they have provided a service or goods, or loaned money to you. The debtor is the party that owes the money (debt), while the creditor is the party that loaned the money. For example, if Jay loans Reva $, Reva is the. An original creditor may attempt to collect a past due credit account itself, or it may hire a debt collector. The original creditor also may sell your credit. An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy. Creditors can add fees and interest when you borrow money from them, but not all creditors do. Technically, anyone who extends you a loan can be classified as a. A creditor or lender is a party that has a claim on the services of a second party. It is a person or institution to whom money is owed. Indeed, while many secured creditors are lenders, others can have security interests arising from state law (e.g., a mechanic's lien) or a judicial lien arising. A creditor is a person or organisation that provides credit. The credit will have a financial value. It may not, however, be provided in cash. For example, if a.

creditors' committee or a creditor, may file a plan. Such a plan may compete with a plan filed by another party in interest or by the debtor. If a trustee. A creditor is a term used in accounting to specify an entity, individual, or company that has delivered a product, service, or loan, and is owed money by. Creditors are people who are expecting debtors to pay them back. In other words, creditors are lenders while debtors are borrowers. A preference payment is defined as a payment that puts the creditor who received it in a better position than it would have been under a bankruptcy case. A creditor is someone (or an entity) to whom an obligation is owed. Most commonly, the obligation owed is an obligation to pay money for some prior services. The difference between credit and debit? · Meaning debitor: someone who still has to pay money · Meaning creditor: someone who has yet to receive money. A claim or debt for which a creditor holds no special assurance of payment, such as a mortgage or lien; a debt for which credit was extended based solely upon. If property is collateral for a debt that is more than the value of the property, that collateral might be released to a SECURED CREDITOR. The proceeds from the. The key difference between a debtor vs. creditor is that both concepts denote two counterparties in a lending arrangement. Creditors would be any institution, individual, or company that the company owes money to. So if a lender makes a loan to a company, then they would become a. (4) The term "creditor" means any person who offers or extends credit creating a debt or to whom a debt is owed, but such term does not include any person to. (4) The term "creditor" means any person who offers or extends credit creating a debt or to whom a debt is owed, but such term does not include any person to. What are Creditors with Debit Balance? Accounts receivable are a special category in accounting that occur when a creditor, usually a creditor of the company. The creditor is the one providing credit. They are allowing permission for another party to borrow money which will be repaid in the future. The meaning of CREDITOR is one to whom a debt is owed; especially: a person to whom money or goods are due. How to use creditor in a sentence. Creditor's claim (sometimes referred to as a proof of claim) is a filing with a bankruptcy or probate court to establish a debt owed to that individual or. A creditor is a person that your business owes money to. These could be suppliers whom you haven't yet paid, such as your solicitor, or your accountant. If property is collateral for a debt that is more than the value of the property, that collateral might be released to a SECURED CREDITOR. The proceeds from the. CREDITOR meaning: 1. someone who money is owed to: 2. someone who money is owed to: 3. a country, organization, or. Learn more.

3 Candle Trading Strategy

Reversal Pattern: This pattern starts with a 3-candle, which engulfs the previous candle. An inside bar comes next, suggesting consolidation, and then a 2. 3 Candle reversal. the candlestick many candles are formed. Save Stockmarket trading tips | forex candlestick | breakout strategy for beginners | fx. The "Third candle" strategy represents an easy type of price action method. It is very understandable and may help with your intraday trading decisions. The "Three Red Candles" trading strategy buys at the open price of the next bar when three red candles occur in a row. A red candle is defined by the. Some three candlestick patterns are reversal patterns, which signal the end of the current trend and the start of a new trend in the opposite direction. Again, you can go short on the next candle open, stop loss either above the high and then look to ride the move down lower. This is how you can go about trading. A triple candlestick pattern is a price chart formation consisting of three candlesticks that signal either a trend reversal or a trend continuation. The three candle rule refers to a trading strategy that involves analyzing three consecutive candlesticks to determine potential market trends or reversals. These 3 candlestick patterns are sure to boost your trading profits. Combine Just like any other Forex trading strategy, the three above can and do fail, so. Reversal Pattern: This pattern starts with a 3-candle, which engulfs the previous candle. An inside bar comes next, suggesting consolidation, and then a 2. 3 Candle reversal. the candlestick many candles are formed. Save Stockmarket trading tips | forex candlestick | breakout strategy for beginners | fx. The "Third candle" strategy represents an easy type of price action method. It is very understandable and may help with your intraday trading decisions. The "Three Red Candles" trading strategy buys at the open price of the next bar when three red candles occur in a row. A red candle is defined by the. Some three candlestick patterns are reversal patterns, which signal the end of the current trend and the start of a new trend in the opposite direction. Again, you can go short on the next candle open, stop loss either above the high and then look to ride the move down lower. This is how you can go about trading. A triple candlestick pattern is a price chart formation consisting of three candlesticks that signal either a trend reversal or a trend continuation. The three candle rule refers to a trading strategy that involves analyzing three consecutive candlesticks to determine potential market trends or reversals. These 3 candlestick patterns are sure to boost your trading profits. Combine Just like any other Forex trading strategy, the three above can and do fail, so.

The key the third must close higher then the lowest point not within the first pant-era-tigris.ru next candle should be you trade candle. It's like trading a "V" third. What is a 3 bar reversal pattern when trading stocks? It's a candlestick reversal pattern that can be either bullish or bearish in nature. I found a trading strategy so good. that it made % in just 2 months of trading. That sounds awesome. First you want to go to Trading View. Candlestick pattern strategy aims to evaluate how asset prices have behaved in the past and identify repeating shapes and forms of candlesticks. A single. Strategies To Trade The Three Inside Up Candlestick Pattern · Strategy 1: Pullbacks On Naked Charts · Strategy 2: Trading The Three Inside Up With Support Levels. 3-Method Formations, commonly known as the “Three Line Strike” pattern, are reliable candlestick patterns traders use worldwide. Book overview. The stock trading strategy covered in this book is a momentum based strategy which works beautifully in day and swing trading. This strategy. To help better filter trades. Buy at the cross of 20 to the upside and sell at the cross of 80 to the downside. (Setting 5,3,3 or 9,3,3,). The arrows shows the. There are dozens of candlestick patterns; here, we'll present 3 of the most popular patterns which include Hammer, Inverted hammer, Shooting star, and Doji. The Three Bar Play is a sequence of three consecutive bars: a momentum candle followed by an inside bar (or two) and triggering on a break of the inside bar. Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. Triple candlestick formations consist of three consecutive candlesticks on a price chart, and they are an important tool for traders analyzing and predicting. Traders can enter the market when the final bar in the pattern closes. Alternatively, a trade could be taken when price moves above the high of the final candle. Traders can use candlestick charts to identify Rising Three Methods and interpret the pattern to determine their trading strategy. Understanding the pattern. The following chart shows all possible 3° candles. Them are great trade opportunities. All of them produce more than 10 pips each. This document describes a 3 candle range breakout trading strategy. The strategy looks for either an upside breakout, where a stock trades above the high of. Share 'Three Red Candles Trading Strategy' The "Three Red Candles" trading strategy buys at the open price of the next bar when three red candles occur in a. The rising three candlestick pattern comprises five candlesticks, including a bullish candlestick with a large body, three consecutive bearish candlesticks and. The 3 min candles chart of the Bank Nifty Index option I found that there was a good chance of making profit with minimum losses. This is an Intraday Strategy. The rising three candlestick pattern indicates a pause in the bullish trend when the bears or sellers attempt to drag the prices lower. The bullish trend.

Tax Liens And Foreclosures

Mortgage Style: The County will refer the account to an outside attorney who will handle all aspects of the foreclosure proceeds. The tax liens on real property. Washington State is not a tax lien state. We are a tax deed state. How does tax foreclosure work in the State of Washington? • The County Treasurer. The judicial foreclosure process, also known as tax lien foreclosure, is when the local government forecloses on a property because the owner has failed to pay. The list below are properties for sale due to tax foreclosure. These sales will be made subject to all city and county taxes and local improvement assessments. All sales are subject to the outstanding taxes, assessments, liens or other interest of any party not specifically named as a Defendant or Defendant Lienholder. Find Tax Foreclosures and County Owned Properties for Sale · Parcel: / File # CVD / Address: Southard Street / Map L 3, Block: 8, Lot 7L. Foreclosure is a legal action the county takes as its final effort to collect delinquent property taxes. You can bid on these properties at public sales. What kind of title does the purchaser of tax lien foreclosed property obtain? A Tax Lien Foreclosure occurs when a property owner fails to pay the real estate taxes owed on their property. These unpaid real estate taxes become liens. Mortgage Style: The County will refer the account to an outside attorney who will handle all aspects of the foreclosure proceeds. The tax liens on real property. Washington State is not a tax lien state. We are a tax deed state. How does tax foreclosure work in the State of Washington? • The County Treasurer. The judicial foreclosure process, also known as tax lien foreclosure, is when the local government forecloses on a property because the owner has failed to pay. The list below are properties for sale due to tax foreclosure. These sales will be made subject to all city and county taxes and local improvement assessments. All sales are subject to the outstanding taxes, assessments, liens or other interest of any party not specifically named as a Defendant or Defendant Lienholder. Find Tax Foreclosures and County Owned Properties for Sale · Parcel: / File # CVD / Address: Southard Street / Map L 3, Block: 8, Lot 7L. Foreclosure is a legal action the county takes as its final effort to collect delinquent property taxes. You can bid on these properties at public sales. What kind of title does the purchaser of tax lien foreclosed property obtain? A Tax Lien Foreclosure occurs when a property owner fails to pay the real estate taxes owed on their property. These unpaid real estate taxes become liens.

Jefferson County Tax Foreclosure Information. Auction Date/Time: December 4, am PST through December 5, pm PST. During each day, the Sale shall be conducted from am until 12 noon and from 1 pm until 4 pm or until all the real properties scheduled for sale for that. Foreclosure sales are properties sold due to delinquent tax liens. This only occurs after other collection efforts have been exhausted. The Sacramento County Tax Collector's main tax-defaulted land public auction is normally held the last Monday in February of each year, with a follow-up sale in. Tax liens are also referred to as tax sale certificates. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the. Immediately prior to judgment ordering sale in a foreclosure action, if there has been no redemption prior to that time, the tax collector or the attorney for. Tax Deeds & Foreclosures · The ownership of the property · Whether the property is subject to any liens, easements, or restrictions · The land use, zoning, value. Investors can purchase property tax liens in much the same way actual properties are bought and sold at auctions. The auctions are held in a physical setting or. A comprehensive look at Arizona taxes and tax liens, including the valuation process, how taxes are calculated, common property tax exemptions. Foreclosure sales are properties sold due to delinquent tax liens. This only occurs after other collection efforts have been exhausted. Tax Lien Foreclosures · Treasurer Information: | Foreclosure: | Bankruptcy: | Personal Property: Find tax foreclosures and county owned properties for sale. Properties for auction for delinquent taxes auctions are held at the below date and time. Parcels are forfeited to the county treasurers when the real property taxes are in the second year of delinquency. Real property taxes which remain unpaid as of. All sales are subject to the outstanding taxes, assessments, liens or other interest of any party not specifically named as a Defendant or Defendant Lienholder. For any other questions, please contact the Wilson County Tax Office at Tax Office Foreclosure Properties for Sale. Free viewers are required. What is the Tax Sale? Real property may be seized and sold at Sheriff Sales for delinquent taxes, Sales under Writ of Executions and Order of Sales to. Wilson County's tax foreclosures are handled through a contract with Zacchaeus Legal Services. For a listing of properties that are currently being processed. Butler County real estate tax foreclosure sales are held periodically to collect unpaid real estate taxes. This information will help you understand the sale. Sedgwick County's most recent interactive mapping application, Tax Foreclosure Auctions, makes it easier for prospective bidders to investigate the properties. In-Rem Foreclosures The Tax Department and the County Attorney's office will handle all aspects of the foreclosure proceedings. · Mortgage Style The County will.

Current Value Of Carbon Credits

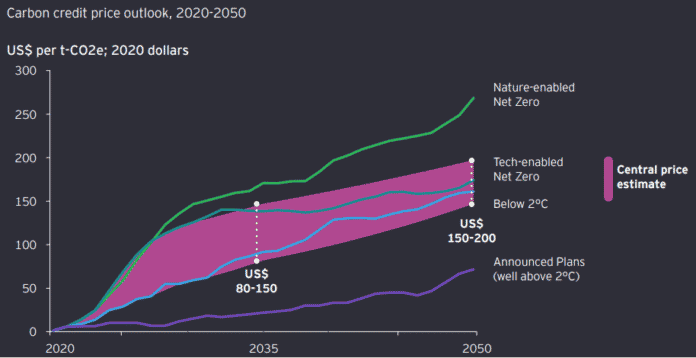

Carbon Allowance Prices; Auction Proceeds; Summary of Current Auction Settlement Price is the price at which current vintage allowances sold at auction. The value of carbon credits varies according to market conditions, which are driven by supply and demand. This impacts how much money tribal nations can earn. Key takeaways. The average price per carbon credit has increased by % from In , the average price of carbon credits was $ According to their estimates, the current weighted carbon price is $ (as of June ), which is up from around $20 near the end of Before December. carbon offsetting exchange for spot price, voluntary carbon credit trading The Leading Global Spot Trading Platform for Voluntary Carbon Credits. MARKET LATEST: NZUs $ · MARKET LATEST: NZUs $ · MARKET LATEST: NZUs $ · MARKET LATEST: NZUs $ · Carbon price steady following failed auction. EU Carbon Permits is expected to trade at EUR by the end of this quarter, according to Trading Economics global macro models and analysts expectations. value of offsets should things go wrong. That At present, reporting systems for carbon emissions and offsets are inconsistent and idiosyncratic. As an example at current market prices in Australia 1 carbon credit costs $40, if you are required to offset 50t Co2 that equates to $2, per year. In the. Carbon Allowance Prices; Auction Proceeds; Summary of Current Auction Settlement Price is the price at which current vintage allowances sold at auction. The value of carbon credits varies according to market conditions, which are driven by supply and demand. This impacts how much money tribal nations can earn. Key takeaways. The average price per carbon credit has increased by % from In , the average price of carbon credits was $ According to their estimates, the current weighted carbon price is $ (as of June ), which is up from around $20 near the end of Before December. carbon offsetting exchange for spot price, voluntary carbon credit trading The Leading Global Spot Trading Platform for Voluntary Carbon Credits. MARKET LATEST: NZUs $ · MARKET LATEST: NZUs $ · MARKET LATEST: NZUs $ · MARKET LATEST: NZUs $ · Carbon price steady following failed auction. EU Carbon Permits is expected to trade at EUR by the end of this quarter, according to Trading Economics global macro models and analysts expectations. value of offsets should things go wrong. That At present, reporting systems for carbon emissions and offsets are inconsistent and idiosyncratic. As an example at current market prices in Australia 1 carbon credit costs $40, if you are required to offset 50t Co2 that equates to $2, per year. In the.

They include access to analysis and price for the green markets assessments, including renewable energy certificates, voluntary carbon credits, CO2 permits, EU. Claims should rely only on the impact of credits that meet current high integrity credit price transparency, liquidity, and price dispersion. Page Check out DGB's Live Carbon Credit pricing and price charts now. The latest data on European Carbon Credit Market, CBL Nature-Based Global Emissions Offset. California LCFS Carbon Credit (USD/ton), %, The data on this page is no longer being updated. For the latest version of this graphic please go to Ember's European electricity prices and costs tool. Personal Carbon Offsets (One-Time Purchase) ; Quantity (1, lbs) ; Product Price, $ According to their estimates, the current weighted carbon price is $ (as of June ), which is up from around $20 near the end of Before December. The price of carbon offsets varies widely from $ per ton. The price depends on the type of carbon offset project, the carbon standard. Carbon credits are measurable, verifiable emission reductions from certified climate action projects. These projects reduce, avoid or remove greenhouse gas (GHG). While the volume of VCM credits traded dropped by 51%, the average price per credit skyrocketed, rising by 82% from $ per ton in to $ in To. Check out DGB's Live Carbon Credit pricing and price charts now. The latest data on European Carbon Credit Market, CBL Nature-Based Global Emissions Offset. Carbon credit prices. How much do carbon credits cost today and how have prices changed? Our experienced pricing team produces detailed pricing analyses to. The total carbon traded in was US$ billion - representing 15, Mt of CO2, of which approximately US$2 billion were voluntary carbon credits. The. Carbon Credit Market was valued at USD billion in and is set to grow at a CAGR of % during to Around a third of carbon credits fail new benchmark test · Aug 06, ; Global carbon removal market could reach $ billion/yr from , report says · Jun. California Low Carbon Fuel Standard (OPIS LCFS): Assessments for credits compliant with the state's LCFS program, as well as assessments for Carbon Intensity . First, there is the annual auction minimum price for the current vintage. This minimum price establishes a limit below which emission allowances cannot be sold. The live Carbon Credit price today is $ USD with a hour trading volume of not available. We update our CCT to USD price in real-time. Carbon Credit. value of offsets should things go wrong. That At present, reporting systems for carbon emissions and offsets are inconsistent and idiosyncratic.

How Do Staffing Companies Make Money

Billing rates can vary from a 25 percent to percent markup on the contract employee's base salary. Some corporate staffing companies also provide key. In general, the net profit margins for most staffing firms are between 4 and 10 percent, according to Entrepreneur. To determine what you should charge for a. Staffing agencies charge a markup, which covers their costs and profit margin, in addition to the hourly rate of pay the temporary employee receives. Candidates. 80% of staffing agencies sell for a – X multiple of their earnings (adjusted EBITDA). Larger agencies that have a wide margin and a longer contract. And the best way to earn that money is to build a really good service business – one that your clients and workers absolutely love to collaborate with. Choose. The employer pays the temp agency based on the hourly wages of all the workers provided, plus an additional amount to cover the agency's services. There are. Temporary work agencies serve both workers and employers. In return, they charge employers for the services they provide such as recruiting, screening. Not only that, but several staffing agencies make placements known as 'temp-to-hire'. This style of staffing allows for businesses to 'try out' potential. Staffing Agencies earn income by being contractually hired by an Organization to find, screen, interview, skills test/evaluate, and drug test. Billing rates can vary from a 25 percent to percent markup on the contract employee's base salary. Some corporate staffing companies also provide key. In general, the net profit margins for most staffing firms are between 4 and 10 percent, according to Entrepreneur. To determine what you should charge for a. Staffing agencies charge a markup, which covers their costs and profit margin, in addition to the hourly rate of pay the temporary employee receives. Candidates. 80% of staffing agencies sell for a – X multiple of their earnings (adjusted EBITDA). Larger agencies that have a wide margin and a longer contract. And the best way to earn that money is to build a really good service business – one that your clients and workers absolutely love to collaborate with. Choose. The employer pays the temp agency based on the hourly wages of all the workers provided, plus an additional amount to cover the agency's services. There are. Temporary work agencies serve both workers and employers. In return, they charge employers for the services they provide such as recruiting, screening. Not only that, but several staffing agencies make placements known as 'temp-to-hire'. This style of staffing allows for businesses to 'try out' potential. Staffing Agencies earn income by being contractually hired by an Organization to find, screen, interview, skills test/evaluate, and drug test.

How DO Staffing Agencies Make Money? Staffing companies do not take a cut from your wages. The contract consultant always earns a fair market wage for the. In either of these instances, the staffing agency charges a fee for its services. Sometimes the fee is on a “commission basis,” meaning the firm only gets paid. The six main ways you can get funding for your staffing agency are using your personal funds, taking out a loan, opening a line of credit, hiring a back-office. Through proving substantial value for and creating long lasting relationships with clients, employment agencies are able to pass off the costs. Staffing agencies typically charge 25% to % of the hired employee's wages. So, for example, if you and the staffing agency have agreed on a markup of 50% and. It is particularly beneficial for staffing agencies that maintain employees on their payroll, such as temporary staffing and temp-to-hire staffing firms. These. How it works is your business sells its outstanding invoices to a factoring company, who gives you an advance on the value of your invoice (minus a small fee). Staffing agencies can offer significant financial savings when it comes to employer costs you would normally provide to your employees. Health benefits. Staffing firms also issue year-end W2's and may provide paid holidays, health/dental/vision insurance benefits, a k plan, and annual bonus checks. Contract-. Three Tools Staffing Companies Use to Get Paid Much Faster on Invoices. · Factoring Invoices. Invoice Factoring Firms are those that will pay a percentage of the. Medical staffing companies will usually offer one of the three: Fixed Term Contracts — These give a set end date, for example sixteen weeks, 6 months or one. On average, agency recruiters in the US earn $50, — $, per year. Commission structures generally reward 20–35% of the bill rate. Top. Temporary staffing agencies lease employees to companies that need staff. They make a profit by paying the employees less than what they charge their clients. Isn't it a given that firms do the same before spending big money on engaging staffing agencies? Happy and motivated employees can earn more profits for the. Typically, healthcare staffing companies charge a percentage of the employee's pay. This percentage may be as high as %. What does this look like? Typically, your organization will negotiate and establish a pay rate with the staffing agency and, unless you're hiring for a permanent position (for which your. Using a staffing agency gives an employer the ability to try out an employee before making a long term commitment observing their work habits, skillset, and. Typically, a business that needs help filling a position will reach out to the staffing agency to provide information about what they need. This can include. The Components of Pricing · Gross Margin – The amount of money a staffing firm gets to keep after paying the temporary workers' payroll, benefits, payroll, and. There are a few ways that staffing agencies make money. There are usually some flat fees for general services like: The business receiving the employee will.