pant-era-tigris.ru News

News

What Are Closing Costs For The Seller

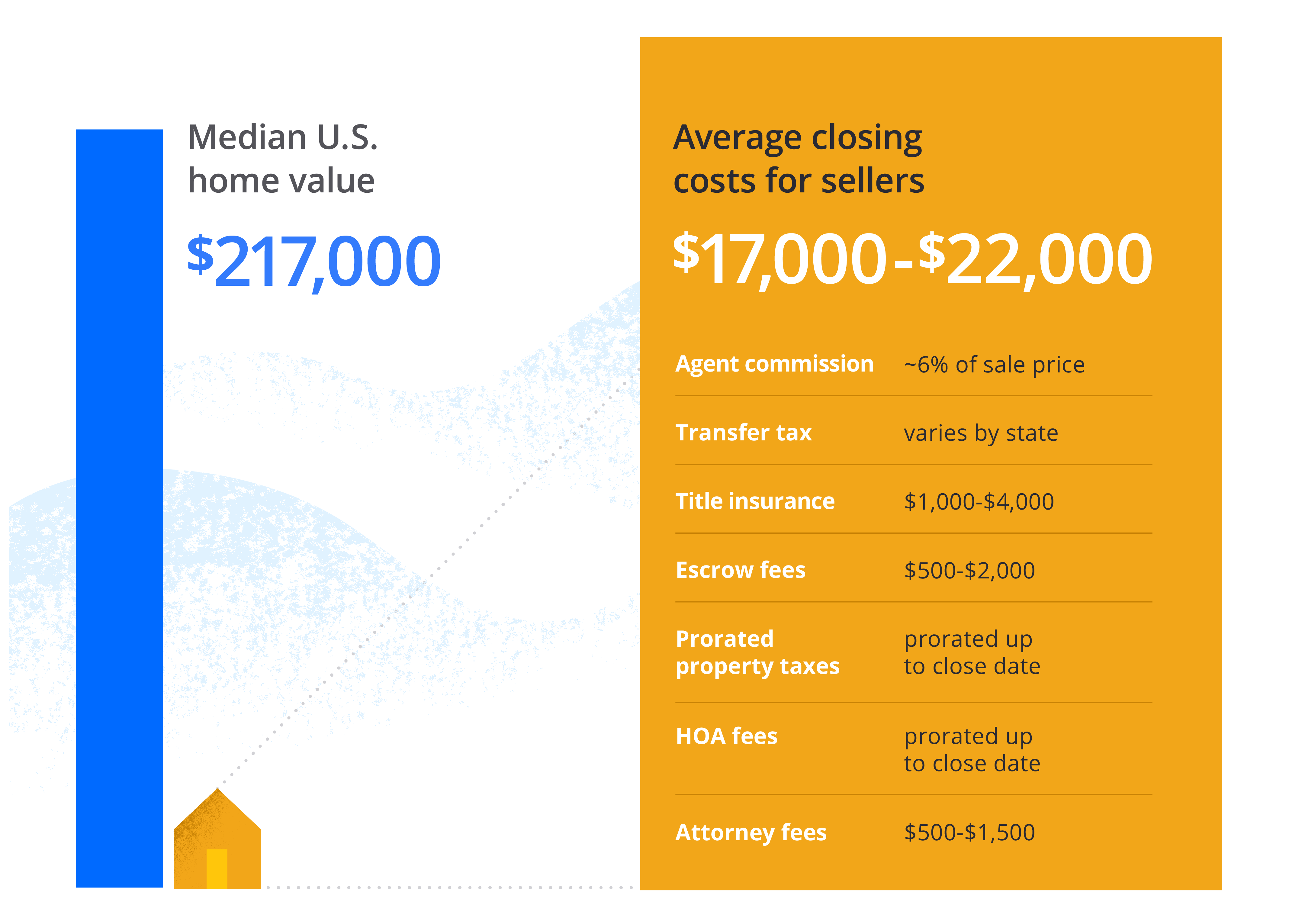

Seller closing costs can range from 8% to 10% of the home selling price. The main categories of seller closing costs include: commission of real estate agents;. Yes, the seller can contribute money toward the buyer's closing costs. This is allowed under most mortgage loan programs, though there may be limits to how much. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. Seller closing costs may include lender payoff fees, property taxes, HOA dues, HOA document and transfer fees, escrow fees, title fees, transfer taxes, broker. Closing costs are the fees and expenses you pay when you close on your home. They include standard expenses such as appraisal fees, title fees and the first. Closing Costs That Sellers Must Cover in Florida The largest fee sellers will be responsible for is the commission for the real estate agent, which varies. A guideline on Average Closing Costs in Ontario ranges between % to 4% of the Purchase Price, for instance, the closing cost for a property purchase price at. Closing costs. Closing costs often run between 2% and 5% of the purchase price of the house. Typically, these costs are paid by the buyer not the seller. Having. Other costs – Property taxes, utilities or condo fees. Prior to closing, your lawyer will give you a full breakdown of any other selling costs, which may. Seller closing costs can range from 8% to 10% of the home selling price. The main categories of seller closing costs include: commission of real estate agents;. Yes, the seller can contribute money toward the buyer's closing costs. This is allowed under most mortgage loan programs, though there may be limits to how much. Estimated closing costs for sellers are usually about 5% to 6% of the sale price in closing costs, while buyers typically pay between 2% and 5%. The bulk of the. Seller closing costs may include lender payoff fees, property taxes, HOA dues, HOA document and transfer fees, escrow fees, title fees, transfer taxes, broker. Closing costs are the fees and expenses you pay when you close on your home. They include standard expenses such as appraisal fees, title fees and the first. Closing Costs That Sellers Must Cover in Florida The largest fee sellers will be responsible for is the commission for the real estate agent, which varies. A guideline on Average Closing Costs in Ontario ranges between % to 4% of the Purchase Price, for instance, the closing cost for a property purchase price at. Closing costs. Closing costs often run between 2% and 5% of the purchase price of the house. Typically, these costs are paid by the buyer not the seller. Having. Other costs – Property taxes, utilities or condo fees. Prior to closing, your lawyer will give you a full breakdown of any other selling costs, which may.

Seller closing costs in NYC are between 8% to 10% of the sale price. Seller closing costs are usually higher for co-ops than condos because most co-ops charge. Closing costs for buyers include fees paid to the mortgage company for originating the loan, legal fees paid to the attorney who handles the real estate. As the homebuyer, you typically pay most of the closing costs. However, the seller usually pays real estate agent commissions and transfer fees. You may be able. Massachusetts Seller Closing Costs · 1. Real Estate Attorney Fee: typically between $$ – depending on the complexity. · 2. Massachusetts Excise Tax. Generally speaking, you'll want to budget between 3% and 4% of the purchase price of a resale home to cover closing costs. For buyers, closing costs often range between 2% and 6% of the purchase price. Seller closing costs most often start at 5% to 6%, since sellers traditionally. No. A Seller Credit to Buyer Closing Costs cannot exceed the total amount of the actual closing costs and prepaid items. For Example: A home buyer's closing. Our guide aims to demystify closing costs in Minnesota, highlighting the differences between buyer and seller obligations and customary practices. Mortgage closing costs are fees and expenses you pay when you secure a loan for your home, beyond the down payment. These costs are generally 3 to 5 percent of. Both buyers and sellers pay closing costs, but usually, the homebuyer is responsible for most of them. As a homebuyer, you are encouraged to negotiate with the. Typically, the seller pays most of the fees, including both real estate agents' commissions. Estimated closing costs for sellers are usually about 5% to 6% of. Closing costs are the various fees paid to end a home purchasing or selling transaction, typically when the title of the home or property is transferred to the. The team from Prevu Real Estate highlights the top closing costs for sellers and buyers in Washington, DC, including how to figure out what you'll pay and how. Closing cost amounts vary depending on the buyer's loan program, but they typically range from 2%–5% of the purchase price. For home seller, the closing cost typically range between 1 – 2% of the sale price and these seller closing cost are paid at the settlement. Typically these won. The typical closing costs on a house (when you're the seller) can range from about 8% – 10% of the sales price. Let's break down the closing costs into the. Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. Typically, total closing costs range from 2 – 5% of a home's purchase price, although this can vary based on where you live and the property you buy. Lenders. In addition to paying for title insurance, the seller typically pays for half of the escrow cost and the buyer pays for the other half. An example rate for. Massachusetts Seller Closing Costs · 1. Real Estate Attorney Fee: typically between $$ – depending on the complexity. · 2. Massachusetts Excise Tax.

What A Mortgage Application

You will complete a mortgage application and the lender will verify the information you provide. They'll also perform a credit check. If you're preapproved, you. How to apply for a mortgage. The underwriting process consists of your mortgage lender reviewing your application and verifying your income, assets, debt and property details. Once. There are several types of items you can include in your mortgage application as an asset. These items can include money, investments, properties, cars. Verify and complete the information on this application. If you are applying for this loan with others, each additional Borrower must provide information as. Issue a “Clear to Close”: It's rare that a file will be issued a clear to close upon first submission. Clear to Close means that your home loan has been. Mortgage Application Information. The first step in applying for a mortgage is completing a standardized form called the Uniform Residential Loan Application. They will ask for some basic information about your earnings and credit history and will try to find out what sort of mortgage product will be suitable for you. What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts. You will complete a mortgage application and the lender will verify the information you provide. They'll also perform a credit check. If you're preapproved, you. How to apply for a mortgage. The underwriting process consists of your mortgage lender reviewing your application and verifying your income, assets, debt and property details. Once. There are several types of items you can include in your mortgage application as an asset. These items can include money, investments, properties, cars. Verify and complete the information on this application. If you are applying for this loan with others, each additional Borrower must provide information as. Issue a “Clear to Close”: It's rare that a file will be issued a clear to close upon first submission. Clear to Close means that your home loan has been. Mortgage Application Information. The first step in applying for a mortgage is completing a standardized form called the Uniform Residential Loan Application. They will ask for some basic information about your earnings and credit history and will try to find out what sort of mortgage product will be suitable for you. What you'll need · W-2s (for the last 2 years) · Recent pay stubs (covering the most recent 30 days) · Complete bank statements for all financial accounts.

Most lenders will ask you to complete Fannie Mae's Uniform Residential Loan Application (also known as the Mortgage Application Form) when you want to buy. The Mortgage Application Process · Steps of the Mortgage Application Process · Complete your application · Get a Loan Estimate · Provide your consent to proceed. Your pre-approval is not binding. You don't have to take a loan from that lender and the lender doesn't have to give you a loan. It just means that you. When you're getting preapproved, though, the lender will verify your creditworthiness. You'll need to complete a mortgage application and provide. Arranging a mortgage can seem complex. Learn the six basic steps to get from application to closing. Get preapproved: Here's what you'll need. · Total monthly income, before and after taxes · Available down payment amount · House payment amount that fits your. Gather These Documents to Apply for a Mortgage · Valid driver's license or other government-issued photo identification—should include date of birth · Social. The Mortgage Lending Process · Preparation · Prequalification · Application · Processing Your Application · Home Inspection · Home Appraisal · Underwriting · Closing. From application to approval and closing, getting a mortgage can take anywhere from 30 days to 60 days. However, some home purchases can take longer, depending. The Weekly Mortgage Applications Survey contains 15 indices covering home loan application activity for fixed rate, adjustable rate, conventional and. Mortgage lenders will be checking both of these to determine your future interest rate. The higher your credit score, the lower your interest rate will be. How to Apply for a Home Loan in 6 Steps · 1. Gather your financial paperwork · 2. Know basic mortgage loan requirements · 3. Choose the right mortgage type · 4. This may include private lenders and mortgage investment corporations. "Loan file" refers to the file retained by the mortgage broker containing the application. 6 tips you need to know before starting the mortgage application process · Reduce your debt. · Meet with a loan officer. · Review your credit history and scores. The Weekly Mortgage Applications Survey contains 15 indices covering home loan application activity for fixed rate, adjustable rate, conventional and. Apply securely in as little as 5 minutes. After completing this form, an Island Savings mortgage specialist will contact you to complete your mortgage. The mortgage application · Paycheck stubs. · W-2's. · Statements from all bank and investment accounts. · Statements for all outstanding debt. · Tax returns. Your request for preapproval will then convert to a mortgage application, and you'll receive a loan estimate within 3 business days. If you review and decide to. To get pre-approved, you'll complete your lender's loan application, providing important information about your credit, debt, work history, down payment and. Non-home monthly expenses. Add it all up—groceries, insurance, cable, internet, subscriptions, clothing, haircuts, gym memberships, health care, the costs of.

Can You Switch Mortgage Companies Without Refinancing

Refinancing or modifying a mortgage loan; Misreporting mortgage account How to get real help if you are having trouble paying your mortgage. LAST. Can I convert my adjustable rate loan to a fixed rate without refinancing? will likely change and the lender will give you a revised Loan. Estimate. At. As the borrower, you have the right to switch mortgage lenders at any time before you sign the loan contract. Still, it's best to do your due diligence upfront. Your lender could also require you to refinance the mortgage with the LLC as the borrower. It is also highly possible that you will need to sign a personal. than million customers per year manage the investment they've made in their homes. We specialize in FHA and VA purchase and refinance loans. You will need to refinance your mortgage. To speak with a Flagstar loan advisor about your refinance options, please call You have no control over it, but it's pretty typical practice. Ours was sold/transferred to five lenders before the last one kept it. you can achieve a lower interest rate without dramatically changing your monthly house payment. Refinancing can allow you to consolidate both loans under one. You have a day grace period after a transfer to a new servicer. That means you can't be charged a late fee if you send your on-time mortgage payment to the. Refinancing or modifying a mortgage loan; Misreporting mortgage account How to get real help if you are having trouble paying your mortgage. LAST. Can I convert my adjustable rate loan to a fixed rate without refinancing? will likely change and the lender will give you a revised Loan. Estimate. At. As the borrower, you have the right to switch mortgage lenders at any time before you sign the loan contract. Still, it's best to do your due diligence upfront. Your lender could also require you to refinance the mortgage with the LLC as the borrower. It is also highly possible that you will need to sign a personal. than million customers per year manage the investment they've made in their homes. We specialize in FHA and VA purchase and refinance loans. You will need to refinance your mortgage. To speak with a Flagstar loan advisor about your refinance options, please call You have no control over it, but it's pretty typical practice. Ours was sold/transferred to five lenders before the last one kept it. you can achieve a lower interest rate without dramatically changing your monthly house payment. Refinancing can allow you to consolidate both loans under one. You have a day grace period after a transfer to a new servicer. That means you can't be charged a late fee if you send your on-time mortgage payment to the.

Typically, the escrow accounts are part of the loan deal, so it would likely be hard to change without a refinance. uh refinancing, if you. Exceptional home lending options and service make Newrez the home of your perfect loan. Apply to refinance or buy a home online today. While this process, commonly referred to as an assumption or a novation, is not common, some lenders do allow it with respect to certain types of mortgage loans. This type of career move may pose a red flag to the lender and will affect loan approval. will change if you switch jobs and if your application process will. You have no control over it, but it's pretty typical practice. Ours was sold/transferred to five lenders before the last one kept it. The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage. you can transfer your home into a Trust if you still have a mortgage you can and cannot do with the house without the lender's consent. The. Can You Add a Co-Borrower to Your Mortgage? Once you have a mortgage on your own, you cannot add a co-borrower without refinancing the loan. Many mortgage. Yes. Federal banking laws and regulations permit banks to sell mortgages or transfer the servicing rights to other institutions. Rate IL - Chicago - assists you with low cost home purchase and refinance mortgages, great service, and fast closings. You don't need your own loan to do the takeover, and it's not subject to due-on-sale restrictions that prohibit transfer without refinancing. That means if you. A no-closing-cost refinance lets you refinance without paying closing costs upfront. Learn how to refinance without closing costs and when it makes sense to. The lender almost certainly will charge transfer fees. A mortgage assumption avoids the cost and uncertainty of refinancing a mortgage, but the terms are very. Pennymac is a leading national home loan lender and servicer. Enjoy great rates and a quick, painless process when you purchase or refinance your next home. Some homeowners choose to fix their loan for 30 or 40 years but may later decide to pay it off sooner. By refinancing your mortgage, you can refigure your loan. You don't need to make any changes yourself. However, if you set up mortgage payments through a third party (such as bill pay through your bank or credit union). So even despite your mortgage being sold to a new lender, your mortgage broker is still able to assist you with refinancing efforts, any new mortgage needs, as. Register now and even if you can't attend, we'll send you a video link after without notice. Any unauthorized use or distribution of this. Typically, the escrow accounts are part of the loan deal, so it would likely be hard to change without a refinance. uh refinancing, if you. pant-era-tigris.ru New Home Loans and Refinancing. For mortgage questions surrounding new home loans and refinancing, you can connect: By Phone:

How Can I Calculate My Tax

You'll need to know your filing status, add up all of your sources of income and then subtract any deductions to find your taxable income amount. Let's look at some examples of how to figure out federal income tax withholding. This will require some math, so grab a pencil and your thinking cap! TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. The income tax calculator helps to determine the amount of income tax due or owed to the IRS. You can also estimate your tax refund if applicable. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Effective Tax Rate = Total Tax ÷ Taxable Income. Effective Tax Rate vs. Marginal Tax Rate. While an effective tax rate represents the percentage of your taxable. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. You can easily calculate your effective tax rate as an individual taxpayer. Do this by dividing your total tax by your taxable income. To get the rate, multiply. Estimate your refund (taxes you file in ) with our income tax calculator by answering simple questions about your life and income. You'll need to know your filing status, add up all of your sources of income and then subtract any deductions to find your taxable income amount. Let's look at some examples of how to figure out federal income tax withholding. This will require some math, so grab a pencil and your thinking cap! TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Use this tool to determine your tax. The income tax calculator helps to determine the amount of income tax due or owed to the IRS. You can also estimate your tax refund if applicable. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. This is tax withholding. Effective Tax Rate = Total Tax ÷ Taxable Income. Effective Tax Rate vs. Marginal Tax Rate. While an effective tax rate represents the percentage of your taxable. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. You can easily calculate your effective tax rate as an individual taxpayer. Do this by dividing your total tax by your taxable income. To get the rate, multiply. Estimate your refund (taxes you file in ) with our income tax calculator by answering simple questions about your life and income.

85% of your Social Security income can be taxed. Learn what is taxable, how benefit taxes are calculated & create a strategy to lower your taxable. This is a tool to help you calculate your total amount due if you have filed or paid late. It has been designed for initial late filings or payments. What's a salary paycheck calculator? A salary calculator lets you enter your annual income (gross pay) and calculate your net pay (paycheck amount after taxes). The calculation is based on the tax brackets and the While almost everyone is subject to federal income tax, not all states have an income tax. Estimate your taxable income (for taxes filed in ) with our tax bracket calculator. Want to estimate your tax refund? Use our Tax Calculator. Calculate your federal taxes with H&R Block's free income tax calculator tool. Answer a few, quick questions to estimate your tax refund. The brackets include a specific income range that varies, depending on filing status (single, married filing jointly, etc.). Each IRS tax bracket has a slightly. This is the percentage paid in Federal taxes on additional income. To determine your marginal tax rate, the tool recalculates your total Federal income tax. Best online tax calculator. Estimate your taxes. Fill in the step-by-step questions and your tax return is calculated. Best online tax calculator. Estimate your taxes. Fill in the step-by-step questions and your tax return is calculated. Free online income tax calculator to estimate U.S federal tax refund or owed amount for both salary earners and independent contractors. Knowing your income tax rate can help you calculate your tax liability for unexpected income, retirement planning or investment income. This calculator. The tax rate for the district that I live in within Wake county is an additional cents per $ value. My taxes would be: $,/ x Your marginal tax rate is the percentage of tax you pay on your last dollar of taxable income. · Your average tax rate is just that—the average amount that you. Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year (6 April to 5 April ). To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1, Depending on your income and filing status, there are 7 IRS tax brackets for the Tax Year: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. It can be calculated by taking the tax the IRS charges you and dividing it by your total earnings for the year. Total tax ÷ adjusted gross income = effective. Use these online calculators to calculate your quarterly estimated income taxes, the interest amount due on your unpaid income tax, or the amount your employer. It should not be used for any other purpose, such as preparing a federal income tax return, or to estimate anything other than your own personal tax liability.

Student Loan Forgiveness Stimulus

This page will help you prepare to make student loan payments and explain how you can have your federal student loans forgiven, canceled or discharged, if. Annual Borrowing – Annual borrowing represents the total new student loan amounts disbursed by the federal government for a given academic year; during the The Supreme Court ruled June 29 that President Joe Biden did not have the authority to erase hundreds of billions of dollars in student loan debt. In addition, approximately $39 billion in federal student loan debt will be forgiven by adjusting accounts to give borrowers credit for time spent in the income. The Supreme Court has stopped Biden from continuing with his plan to forgive up to $20, of federal student loans for eligible borrowers. Source 21 Jun During the coronavirus crisis, federal student loan payments have been suspended to the end of the calendar year. Following the presidential election, there. If my student loans are forgiven through the Biden-Harris Administration's Student Debt Relief Plan, is the amount forgiven taxable for Wisconsin purposes? What does the new student loan forgiveness plan mean for you? Find out how this plan may impact your loans and your taxes from H&R Block. On August 23, , President Biden announced a Student Debt Relief Plan that includes one-time student loan debt relief targeted to low and middle-income. This page will help you prepare to make student loan payments and explain how you can have your federal student loans forgiven, canceled or discharged, if. Annual Borrowing – Annual borrowing represents the total new student loan amounts disbursed by the federal government for a given academic year; during the The Supreme Court ruled June 29 that President Joe Biden did not have the authority to erase hundreds of billions of dollars in student loan debt. In addition, approximately $39 billion in federal student loan debt will be forgiven by adjusting accounts to give borrowers credit for time spent in the income. The Supreme Court has stopped Biden from continuing with his plan to forgive up to $20, of federal student loans for eligible borrowers. Source 21 Jun During the coronavirus crisis, federal student loan payments have been suspended to the end of the calendar year. Following the presidential election, there. If my student loans are forgiven through the Biden-Harris Administration's Student Debt Relief Plan, is the amount forgiven taxable for Wisconsin purposes? What does the new student loan forgiveness plan mean for you? Find out how this plan may impact your loans and your taxes from H&R Block. On August 23, , President Biden announced a Student Debt Relief Plan that includes one-time student loan debt relief targeted to low and middle-income.

I will start to use existing laws on day one of my presidency to implement my student loan debt cancellation plan that offers relief to 42 million Americans. The stimulus plan includes The Student Loan Tax Relief Act, which exempts student loan debt forgiveness from federal taxes through The change would. What You Need to Know about Debt Relief in the Federal Stimulus Package: · The CARES Act defers student loan payments for all federally held loans for 6 months. PUBLISHED: February 22, at a.m.. On February 21, the Biden administration announced a new $ billion round of student loan forgiveness. In August , President Biden proposed to provide up to $20, in federal student loan forgiveness to tens of millions of borrowers. The announcement, which. Economists generally call student loan forgiveness "regressive" because it will primarily benefit higher earners: stimulus on the. In August , President Biden announced a plan to cancel up to $10, of debt for federal student loan holders and up to $20, of debt for all federal. A blog about student loans from The Law Office of Adam S. Minsky. Student loan news, repayment plan information, and more. President Biden's forgiveness program would absolve borrowers of up to $ in debt. But not everyone thinks its a good idea. The federal emergency relief bill (the CARES Act) suspends payments and interest accrual for federal student loans through September 30th. I've called on the. Student loan forgiveness releases borrowers from their obligation to repay part or all of their federal student loan debt. Despite this, President Biden has been busy unveiling targeted federal loan forgiveness to qualifying borrowers. Since the administration took office in Borrowers only begin repaying their federal student loans six months after leaving an institution, whether by graduating or dropping out. Repayment rates. Enacting loan forgiveness would have the immediate effect of acting as a stimulus package. While most rebates are used to pay off debt, those liberated from the. Despite this, President Biden has been busy unveiling targeted federal loan forgiveness to qualifying borrowers. Since the administration took office in Loans have been scaring off students who wish to further their education and live their lives comfortably after college. If student loans were to be forgiven. Total outstanding student loan debt in America is expected to exceed $ TRILLION this year. Millions of hardworking, taxpaying, educated Americans are. Higher education provides students many socioeconomic benefits and increases the global competitiveness of the United States, but mounting student loan debt. Student debt creates decades of hardship for millions of American families while acting as a drag on the economy. □. Student loans are one of the highest.

What Time Does Chime Open

Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. How long do we have to sit on the waitlist before you guys determine eligibility?? 3 mos. 9. Chime observes all US federal and bank holidays. On these days, banks don't process deposits which may delay direct deposits until the next business day. Chime does not have branches but makes a Member Services team available 24/7 at You can also chat with Chime via the mobile app by tapping the. This business provides only online financial services and users note that the Chime Bank customer service number is available 24 hours a day, 7 days a week. Want to handle their banking from their phones. Looking for a company that does its best to help customers. Find it difficult to open an account with other. Your Chime Visa Debit Card is usually placed in the mail within one (1) business day after you open your Checking Account. It can take 5 to 10 business days for. Open the Google Home app. · Tap and hold your device's tile. · Tap Settings Doorbell Check that Ring indoor chime is set to On. · Tap More Quiet Time, then tap. Anytime, anywhere support. If you need help, Chime's support channels are standing by 24/7. Reach our friendly team by phone, in the app, or check. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. How long do we have to sit on the waitlist before you guys determine eligibility?? 3 mos. 9. Chime observes all US federal and bank holidays. On these days, banks don't process deposits which may delay direct deposits until the next business day. Chime does not have branches but makes a Member Services team available 24/7 at You can also chat with Chime via the mobile app by tapping the. This business provides only online financial services and users note that the Chime Bank customer service number is available 24 hours a day, 7 days a week. Want to handle their banking from their phones. Looking for a company that does its best to help customers. Find it difficult to open an account with other. Your Chime Visa Debit Card is usually placed in the mail within one (1) business day after you open your Checking Account. It can take 5 to 10 business days for. Open the Google Home app. · Tap and hold your device's tile. · Tap Settings Doorbell Check that Ring indoor chime is set to On. · Tap More Quiet Time, then tap. Anytime, anywhere support. If you need help, Chime's support channels are standing by 24/7. Reach our friendly team by phone, in the app, or check.

Significantly, members who fund their Chime accounts with Plaid spend more than five times Open Finance Solution · Core Exchange · Permissions Manager · App. At the same time, these signals can be combed for fast, transient radio emission, making CHIME a unique telescope for discovering new "Fast Radio Bursts" and. Key security features include two-factor authentication, transaction alerts and the ability to block your card in real-time through the mobile app. How to Open. Setup — Balance Wheel Mantel Clock: This type of clock usually starts by itself upon winding. If it does not, open the back door and start the balance wheel. When I had chime it would usually come sometime between 10PM-6AM. The time always fluctuated, it was never consistent. I am with Huntington . Chime Banking Review · Year Founded · Official Website pant-era-tigris.ru · Banking Products Offered Savings, spending · Customer Service Phone line: Monday–. Can I open another Chime account? Ensure you still need an account with No, Chime cannot reactivate a card that has been deactivated. Save Time. Chime strives to make most direct deposits accessible by AM Eastern Standard Time (EST) on your designated payday, including Wednesdays. This hollow metal tube measures about 1 foot long and weighs 1 pound. You can strike it as an action, pointing it at an object within feet of you that can. Chime does not offer members the option of having multiple accounts. Does You must have a Chime Checking Account to open a Chime Savings Account. 6. open Saturday Sunday and all federal holidays how many more days But this time that did not happen.. and usuly on non holiday I get. How can we help? Popular Articles · SpotMe® · Account Info · Direct Deposit · Your Card · Checking Account · The Chime App. Chime does not require a credit check to open an online bank account. We provide services that are inclusive of all Americans. This includes those who struggle. Opening times: Monday-Friday, ampm. Services available: Simple repairs (eg. ear mould retubing, ear mould modifications and replacement of faulty aids). time with no extra legwork on your part. The optional Save How Does Chime's Savings Account Work? You must open a Chime checking account to open a Chime. ²Avg 30 point FICO® Score 8 increase over time with regular on-time payments. Chime is just what you would expect out of a bank. You can open a checking. open water wherever the depth does not exceed 50 meters. In addition, thanks to the ample on-board storage and downlink on-board resources, the coastal. CHIME Institue's Schwarzenegger Community School is located in Woodland Hills, CA. SANJIE WIRELESS DOOR CHIME SENSOR: Sanjie wireless door chime is visitor alert kit for family and business. It would alert door chimes when door opens or. If you're an existing Chime customer, you can refer a friend to open a new Chime account. How long does it take to receive the Chime promotion? According to.

Offshore Call Centres

Outsourcing Customer Support · It Is Less Expensive. An outsourced call center manages your call operations. · It Improves Customer Experience · It Provides. Worldwide Call Centers was founded in with the sole mission of helping our clients successfully deploy call center outsourcing services. To this end, our. Looking for an offshore call center? Find the perfect partner and save up to 70% on outsourcing costs! Get started with a free cost proposal! UK Call Centres V's Offshore Call Centres · 1. Tech Support Thriving Offshore · 2. UK Based Centres Seeing Higher Engagement and Conversion · 3. The offshore explosion The nineties saw an explosion in the deployment of offshore service centres, the most popular destinations being China, India. Many of the banks that received federal government bail-outs during the financial crisis are among the largest companies sending U.S. call center jobs offshore. Suspect they are just using overseas call centres for surge capacity. Aha, do you work in an offshore call centre, perchance? Upvote 1. The best and the most cost-effective offshore call centers all over the world are in India. Offshore call centers help in saving money and time. Offshore call. 1.) Offshore Call Center Agencies – · Consumer Lead Generation or Sales with very large targets/lists · High Volume Inbound Customer Support · Back Office. Outsourcing Customer Support · It Is Less Expensive. An outsourced call center manages your call operations. · It Improves Customer Experience · It Provides. Worldwide Call Centers was founded in with the sole mission of helping our clients successfully deploy call center outsourcing services. To this end, our. Looking for an offshore call center? Find the perfect partner and save up to 70% on outsourcing costs! Get started with a free cost proposal! UK Call Centres V's Offshore Call Centres · 1. Tech Support Thriving Offshore · 2. UK Based Centres Seeing Higher Engagement and Conversion · 3. The offshore explosion The nineties saw an explosion in the deployment of offshore service centres, the most popular destinations being China, India. Many of the banks that received federal government bail-outs during the financial crisis are among the largest companies sending U.S. call center jobs offshore. Suspect they are just using overseas call centres for surge capacity. Aha, do you work in an offshore call centre, perchance? Upvote 1. The best and the most cost-effective offshore call centers all over the world are in India. Offshore call centers help in saving money and time. Offshore call. 1.) Offshore Call Center Agencies – · Consumer Lead Generation or Sales with very large targets/lists · High Volume Inbound Customer Support · Back Office.

We're fluent in multilingual call center outsourcing. · 30+ languages supported by our vendors · Call centers in over 40 countries, 6 continents · Bilingual and. 1. Costs. I personally don't think the primary driver for anyone to send their call centre offshore is for a better customer experience. With some offshore call. When a medical emergency arises off-hours, healthcare providers can use outsourced call centers to receive calls and route them to an on-call physician. Retail. In the fast-paced business landscape of , many companies are turning to call center outsourcing to streamline their operations and deliver exceptional. As an expert offshore call center provider, Flatworld has over 20 years of experience in meeting the offshore call center outsourcing of global customers. How much do offshore call center jobs pay per hour? · $ - $ 1% of jobs · $ - $ 4% of jobs · $ - $ 8% of jobs · $ is the 25th. call center composed of professionals across various locations, languages, and time zones. Off-shore call centers can sometimes cause language barriers. Offshore Business Processing is an established and recognized offshore solutions provider in contact center outsourcing industry. We leverage our experience and. Customers sometimes had trouble understanding the English spoken by overseas agents. Companies with large offshore call centres attracted negative media. If you crawl the call centre newsgroups on the Internet, you will find countless articles for and against offshore outsourcing. The articles in favour of. Time Efficiency — this is a big onshore and offshore difference because offshore call centers are more efficient since they have strict KPIs they need to reach. Best Countries for Call Center Outsourcing · The Philippines. The Philippines has steadily risen to become the crown jewel of the call center industry. · India. What is contact or call center outsourcing? Simply put, call center outsourcing involves contracting a team of agents that work outside of your company. It. 1. Costs. I personally don't think the primary driver for anyone to send their call centre offshore is for a better customer experience. With some offshore call. Flatworld was awarded the contract for the customer's call center offshore outsourcing based on the solution it highlighted to drive the customers sales. American Call Center Services. SAS is a US based company with call center services delivered from our American call center location. While many businesses may. Offshore call centre hourly rates vary wildly but A$A$20 would be the most common range in countries like the Philippines or Fiji. It's a mistake, however. Try to do direct contact first.. browse list of companies and call them offering your services, it will not get you a projects, but you get a. How to Start an Outbound Call Center Overseas · Summary: · Choose the right location for setting up your outbound call center services · Find and hire your. offshore the call centres again. One overseas call centers allow calls from other time zones to be handled as well.

Valkyrie Etf

Alternative asset management firm specialized in the digital asset economy. (ETF disclosures: pant-era-tigris.ru & pant-era-tigris.ru). The latest international Valkyrie Bitcoin Strategy ETF news and views from Reuters - one of the world's largest news agencies. The fund is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing all or substantially all of its. Real time Valkyrie ETF Trust II - Valkyrie Bitcoin Miners ETF (WGMI) stock price quote, stock graph, news & analysis. Valkyrie Bitcoin has less than a 10 % chance of experiencing some financial distress in the next two years of operation, but did not have a good performance. ETF strategy - VALKYRIE BITCOIN AND ETHER STRATEGY ETF - Current price data, news, charts and performance. The Valkyrie Bitcoin Fund (the “Trust”) is an exchange-traded fund that issues common shares of beneficial interest (the “Shares”), which represent units of. Get the latest Valkyrie Bitcoin and Ether Strategy ETF (BTF) real-time quote, historical performance, charts, and other financial information to help you. The fund is an actively-managed exchange-traded fund (“ETF”) that will invest at least 80% of its net assets (plus borrowings for investment purposes) in. Alternative asset management firm specialized in the digital asset economy. (ETF disclosures: pant-era-tigris.ru & pant-era-tigris.ru). The latest international Valkyrie Bitcoin Strategy ETF news and views from Reuters - one of the world's largest news agencies. The fund is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing all or substantially all of its. Real time Valkyrie ETF Trust II - Valkyrie Bitcoin Miners ETF (WGMI) stock price quote, stock graph, news & analysis. Valkyrie Bitcoin has less than a 10 % chance of experiencing some financial distress in the next two years of operation, but did not have a good performance. ETF strategy - VALKYRIE BITCOIN AND ETHER STRATEGY ETF - Current price data, news, charts and performance. The Valkyrie Bitcoin Fund (the “Trust”) is an exchange-traded fund that issues common shares of beneficial interest (the “Shares”), which represent units of. Get the latest Valkyrie Bitcoin and Ether Strategy ETF (BTF) real-time quote, historical performance, charts, and other financial information to help you. The fund is an actively-managed exchange-traded fund (“ETF”) that will invest at least 80% of its net assets (plus borrowings for investment purposes) in.

In conclusion, Valkyrie ETFs, like "Valkyrie Bitcoin Trust" (BTF) and "Valkyrie Innovative Balance Sheet ETF" (WGMI), offer investors a gateway to disruptive. How to buy BTF ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in BTF ETF. The fund is an actively-managed exchange-traded fund (ETF) that will invest at least 80% of its net assets (plus borrowings for investment purposes) in. Learn the comprehensive overview for VALKYRIE ETF TR II BTF. The fund is an actively-managed exchange-traded fund (ETF) that will invest at least 80% of its net assets (plus borrowings for investment purposes) in. ETF strategy - VALKYRIE BITCOIN MINERS ETF - Current price data, news, charts and performance. Valkyrie WGMI ETF (Valkyrie Bitcoin Miners ETF): stock price, performance, provider, sustainability, sectors, trading info. Find the latest quotes for Valkyrie Bitcoin and Ether Strategy ETF (BTF) as well as ETF details, charts and news at pant-era-tigris.ru BTF ETF in-depth analysis and real-time data such as the investment strategy, characteristics, ETF Facts, price, exposure, AuM, Expense Ratio, and more. WGMI - Valkyrie Bitcoin Miners ETF Portfolio Holdings. The fund is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing all or substantially all of its assets. Learn more about Valkyrie ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. WGMI | A complete Valkyrie Bitcoin Miners ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. How to buy BTF ETF on Public · Sign up for a brokerage account on Public · Add funds to your Public account · Choose how much you'd like to invest in BTF ETF. In conclusion, Valkyrie ETFs, like "Valkyrie Bitcoin Trust" (BTF) and "Valkyrie Innovative Balance Sheet ETF" (WGMI), offer investors a gateway to disruptive. Latest Valkyrie Bitcoin Miners ETF (WGMI:NMQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile. View Valkyrie Bitcoin and Ether Strategy ETF (BTF) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. If the lower trend floor at $ is broken, it will firstly indicate a stronger fall rate. Given the current short-term trend, the ETF is expected to fall -. Get detailed information about the Valkyrie Bitcoin Strategy ETF (BTF). View the latest price charts, technical analysis and performance reports. Complete Valkyrie Bitcoin Miners ETF funds overview by Barron's. View the WGMI funds market news.

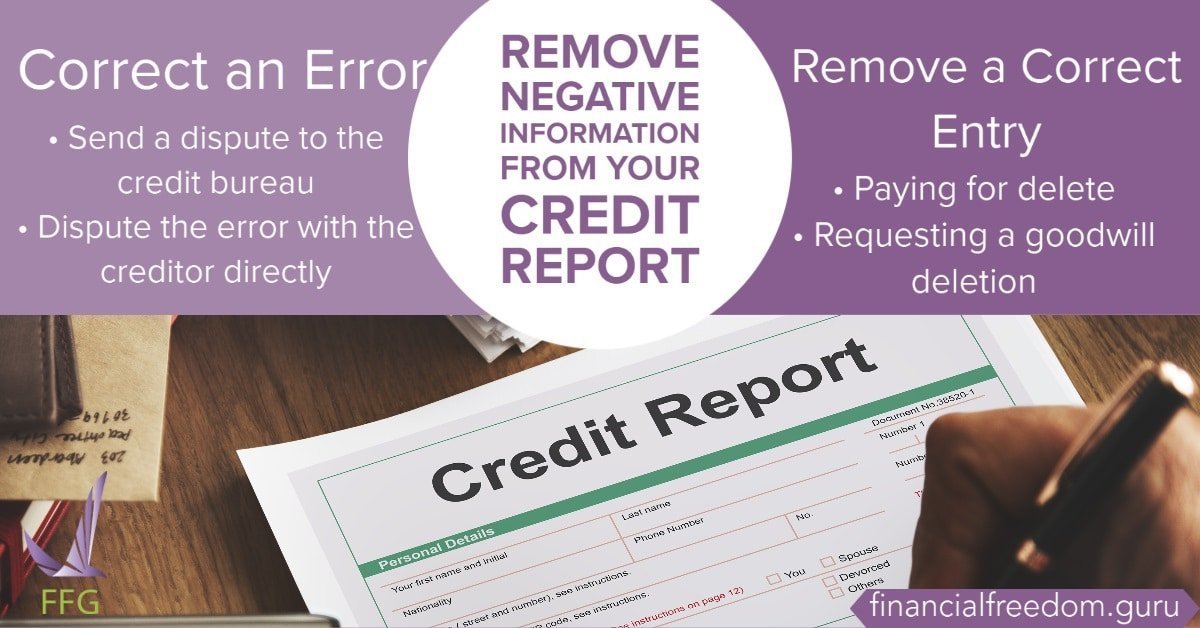

Dispute Negative Items On Credit Report

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be. Certain items may be disputed directly online when viewing your credit report. If an item is available to be disputed online, all dispute options available will. If you believe any item in your Equifax credit report is incomplete or inaccurate, you can begin the dispute process by creating or signing your myEquifax. When a credit reporting agency receives a dispute, it must reinvestigate and record the current status of the disputed items within a "reasonable period of time. You can also dispute credit report errors directly with the creditor that furnished the information to the CRA. Send a separate dispute letter to the creditor. If a negative item in your credit report is not accurate, you can dispute it. You inform the credit bureau of the error, by letter or online. The credit. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. Removing accurately reported items is not possible. You can try writing to your creditor for a goodwill deletion for a one-off late payment outlier. Another. I would suggest disputing by certified mail. You should first obtain an official copy of your credit reports, from Annual Credit Report (website. Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be. Certain items may be disputed directly online when viewing your credit report. If an item is available to be disputed online, all dispute options available will. If you believe any item in your Equifax credit report is incomplete or inaccurate, you can begin the dispute process by creating or signing your myEquifax. When a credit reporting agency receives a dispute, it must reinvestigate and record the current status of the disputed items within a "reasonable period of time. You can also dispute credit report errors directly with the creditor that furnished the information to the CRA. Send a separate dispute letter to the creditor. If a negative item in your credit report is not accurate, you can dispute it. You inform the credit bureau of the error, by letter or online. The credit. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. Removing accurately reported items is not possible. You can try writing to your creditor for a goodwill deletion for a one-off late payment outlier. Another. I would suggest disputing by certified mail. You should first obtain an official copy of your credit reports, from Annual Credit Report (website.

5. Follow Up If Your Dispute is Rejected What if the credit bureau comes back claiming the negative information is verified as accurate? Don't give up. You. Dispute it again. If you submit the dispute again, be sure to provide some new information. · Add an explanatory statement to the report. · Submit a complaint to. If this is not the case after a few months, you need to file a dispute. Your creditors will require some time to report the information accurately, so you. The credit reporting company and the creditor should investigate the dispute or fix any mistake. If the dis- puted information is wrong or cannot be verified. To submit a dispute to a credit reporting company, contact the credit reporting company who has the inaccurate information on your credit report. You may submit. Generally, it can take several months for an inaccurate item to be removed from your credit report following a dispute. However, the length of time required to. Look for some form of the word “dispute” in the Notes portion of the account's information to identify a disputed account. Unfortunately, disputed accounts are. You can dispute the item with the credit bureaus, and/or creditors or debt collectors, and they'll make a decision as to whether to remove it. Under the Fair Credit and Reporting Act, you're entitled to challenge any items you deem as incorrectly attributed to you, have incorrect information, or are. In other words, you aren't punished for questioning the information on your credit report. That said, the information in the dispute could have a negative. the credit reporting agency is legally required to delete the disputed information from your credit report. appears on your credit report as a negative item. Credit bureaus must investigate the item(s) in question-usually within 30 days-unless they consider your dispute frivolous. Include copies (NOT originals) of. Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies–. You can't dispute your credit scores. However, if you think your score is lower than it should be, closely review your credit reports for negative information. Lingering negative information that ought to have aged out; everything but personal bankruptcy (10 years) should drop off your report after seven years. Step 1: Obtain Copies of Your Credit Reports · Step 2: Review Your Credit Reports · Step 3: Identify Inaccuracies · Step 4: Draft a Dispute Letter · Step 5: Send. “You may, on your own, notify a credit bureau in writing that you dispute the accuracy of information in your credit file. The credit bureau must then. And if they don't respond, the disputed information must be removed from the credit report. Credit repair companies file lots of disputes and wait for the. If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. This is. In addition to writing to the credit reporting agency, tell the creditor or other information provider in writing that you dispute an item. Again, include.

Best Companies For Refinancing Student Loans

Earnest is on this list because it's one of the most flexible student loan refinancing companies - they offer the ability to pick any monthly payment and term. Student Loan Refinancing. Scholarships. Financial Solutions. Learn More Navient Named a Best Place to Work for Caregivers. Learn MoreView All. Industry. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! What is the difference between student loan private refinancing and student loan consolidation Here's some of the best lenders to private refinance your. Pre-qualify with 17+ lenders to refinance your student loans through a single form in as little as three minutes. Refinancing with the right lender can lower your interest rate, consolidate multiple loans into one monthly payment, and reduce your total monthly loan. Top lender interest rates ; SoFi Student Loan Refinancing. · Check rate on SoFi's website. on SoFi's website. %. ; LendKey Student Loan. Compare student loan consolidation interest rates from top lenders ; Citizens · · ; ELFI · · ; EdvestinU · · whatever gives you the best rate, I went with Commonbond. I used one of the websites like Credible that put your information into a bunch of. Earnest is on this list because it's one of the most flexible student loan refinancing companies - they offer the ability to pick any monthly payment and term. Student Loan Refinancing. Scholarships. Financial Solutions. Learn More Navient Named a Best Place to Work for Caregivers. Learn MoreView All. Industry. Looking to refinance student loans and lower your monthly payment? Compare student loan refinancing options on LendingTree, rates as low as %! What is the difference between student loan private refinancing and student loan consolidation Here's some of the best lenders to private refinance your. Pre-qualify with 17+ lenders to refinance your student loans through a single form in as little as three minutes. Refinancing with the right lender can lower your interest rate, consolidate multiple loans into one monthly payment, and reduce your total monthly loan. Top lender interest rates ; SoFi Student Loan Refinancing. · Check rate on SoFi's website. on SoFi's website. %. ; LendKey Student Loan. Compare student loan consolidation interest rates from top lenders ; Citizens · · ; ELFI · · ; EdvestinU · · whatever gives you the best rate, I went with Commonbond. I used one of the websites like Credible that put your information into a bunch of.

Best Student Loan Refinance Companies · Student Loans Without Co-Signer Best Lenders for Refinancing Student Loans for Borrowers With No Degree · Best. Our list of the seven best student loan refinance lenders for is designed to help you do just that, as each offers multiple refinance options at a wide. How to refinance your student loans · Research the lenders who are highly rated for refinancing. · Compare their interest rates to see who offers the best rates. RISLA is nationally recognized by NerdWallett as the Best of Awards for Best Student Loan Refinancing. RISLA provides fixed, low interest rates nationwide. Pay less on student loans, get more out of life with Credible. No impact to credit score. Lower your monthly payment with rates as low as %! Purefy's rate comparison tool is an easy way to compare lenders and find the best student loan refinance. You will be presented with real, prequalified rates. Borrowers refinance student loans with lenders like SoFi and Earnest to get a lower interest rate, which helps save money and pay off your student loan debt. Compare the best student loan refinance lenders ; Laurel Road. % to % ; SoFi. % to %* ; RISLA. % to % ; College Ave. % to %. Compare Student Loan Refinance Rates · How Purefy Works: Our Rate Comparison Process · Transparent. Accurate. Safe. · How Student Loan Refinancing Saves People. %APR · “Happy I found Earnest. The approval process was much better than other companies and truly focused on helping people reduce their interest rates.” · “. LendKey: Best for getting matched with a community lender. Lendkey. Looking to refinance a student loan? It's important to shop around for the best interest rate, fees, terms and conditions to suit your needs. Best Student Loan Refinancing Companies. Lender, Rating, Fixed APR, Variable APR, Apply. Lender RISLA, Rating A, Fixed APR % – %, Variable APR None. NaviRefi by Navient believes getting a great rate and refinancing your student loans should be easy. With a fast application process and no fees, including. Best Student Debt Refinancing and Consolidation ; Docupop. Overall Score · 58 User Reviews. % Error-Free Documents Guaranteed; Access to Career Support. Best place to refinance student loans · Citizens Bank: No degree requirement and co-signer release after 36 payments, but higher rate ceilings. But what if you've got private student loans? Well, those are a whole different beast. Most private lenders are only out to make money—not help you stay on top. Refinance your student loans before rates go up. Fixed rates starting as low as % APR* with autopay. Student loan refinancing done fast, easy, & online! With refinancing, you can consolidate the existing private and federal student loans into a new loan with a lower interest rate. That means lower monthly. Low rates, flexible terms, and personalized service for refinancing your student loans. See why we were named a Best Student Loan Refinance Company by US.